The unnatural crisis of the global stock markets

By

Gary Wilson

Published Mar 6, 2007 11:52 PM

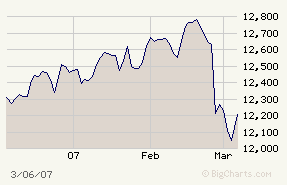

The global stock market drop that started Feb. 27 had wiped out $2.4 trillion

by March 5, the New York Times reported. On March 6, the Wall Street-based

Bloomberg News service called it a “global market collapse.”

Bloomberg reported on “fear” in the markets and reports a New York

Bank official saying there’s “no end in sight” of traders

fleeing the stock markets.

The steepest drops were in Asia—Japan, India and China, with the

Philippines showing the heaviest losses.

The U.S. stock exchange has seen a steady decline since March 1. It’s

been a jarring reminder of the unstable base capitalist markets are built

on.

On Feb. 28, the day of the biggest fall in the U.S. markets, the New York Times

reported, “The nation’s manufacturing sector managed to slip into a

recession with almost nobody seeming to notice.” Not a general recession,

but a recession nevertheless in manufacturing.

What does that mean? Jobs are being wiped out, factory jobs in workplaces like

General Motors, Ford and Chrysler.

A recent study by the Center for Economic Policy and Research confirms that

those hardest hit by the recession in manufacturing have been Black

workers.

“African-American workers have been particularly hard hit by the decline

in U.S. manufacturing,” says the study released March 1.

“Chrysler’s recent buyouts signal the continuing decline of the

U.S. auto industry, which has had a disproportionate effect on the

African-American workforce. Manufacturing jobs, particularly unionized jobs in

the auto industry, have been an important source of well-paid employment for

African-Americans since World War II.”

Other recent economic news also reveals a severe downturn for all but the

richest sector of the U.S. economy.

A Feb. 22 McClatchy Newspaper report said that the percentage of the U.S.

population living in severe poverty “has reached a 32-year high.”

According to this same report, at least 16 million working people in this

country are paid so little that they are living in “deep or severe

poverty.”

Poverty has increased by 26 percent since the year 2000, pushing “43

percent of the nation’s 37 million poor people into deep poverty,”

the report adds.

Left out of all the reports and statistics are the millions of undocumented

workers, immigrants who also live in severe poverty and are paid sub-minimum

wages.

What isn’t said is that recessions don’t have to happen. Recessions

were unknown throughout human history until the advent of capitalism.

Recessions are unnatural disasters, nothing like a natural disaster such as a

tornado.

Nothing natural about crises

A commonly-believed myth is that recessions are inevitable and there’s

nothing you can do about it.

That’s a myth of capitalism, a myth that is believed by many even though

Karl Marx exposed it as a myth more than 150 years ago.

Marx was a scientist whose research was able to reveal the inner workings of

the economy. He showed that capitalism, which regularly has cycles of bust and

boom, is not based on a force of nature. Capitalism’s economic forces are

created by people and can ultimately be controlled by people.

Gold or diamonds, for example, appear to be valuable independently of the

tremendous labor necessary to bring them out of the earth and then refine them.

Yet it is the labor that gives them their real value.

The economy appears to have a life of its own. Recessions and stock market

declines might seem to happen all on their own, spurred on by uncontrollable

forces.

The source of recessions and stock market crashes, however, does not lie in any

mysterious powers or unknown force.

No Wall Street capitalist thinks that either. As economist Paul Krugman, a New

York Times columnist, wrote on March 2: “At the start, all sorts of

implausible explanations were offered for the drop in U.S. stock prices. It

was, some said, the fault of Alan Greenspan, the former chairman of the Federal

Reserve. ... One Republican congressman blamed Rep. John Murtha, claiming that

his efforts to stop the ‘surge’ in Iraq had somehow unnerved the

markets.”

Krugman continues: “Even blaming events in Shanghai for what happened in

New York was foolish on its face, except to the extent that the slump in

China—whose stock markets had a combined valuation of only about 5

percent of the U.S. markets’ valuation—served as a wake-up call for

investors.

“The truth is that efforts to pin the stock decline on any particular

piece of news are a waste of time,” Krugman concludes. There is no

specific event that causes a stock market crash or a recession.

The source for capitalist crises, as Marx the scientist revealed, comes from

the way that capitalist production is organized. The source of

value—workers’ labor power—is hidden. Because the source of

value is hidden, it is difficult to see that this is the key to

capitalism’s rises and falls.

Products seem to have a value on their own, when in fact it is the labor power

put into production of the commodities that gives them their value. The magic

of money is that it represents labor power and labor power is the source of

wealth.

All values exchanged on the market are created by labor. The Wall Street stock

market is like a gambling house where traders speculate on future values

produced by labor. The stock market anticipates in an imprecise way how much

surplus value—that is, how much profit—the capitalists will be able

to get out of the workers.

A “bubble” in the stock market comes when the cost of stocks far

exceeds the actual profits that a company is able to get from the labor of the

workers.

There is no way to predict what will happen on Wall Street, whether there will

be a sudden fall or rise. But the fact is that capitalism is an inherently

unstable system and there will be crises and recessions and increasing poverty

as well as booms and soaring profits for a small few.

The important thing to know is that it doesn’t have to be that way. The

source of the problem is capitalism and not some force of nature. And

capitalism can be replaced.

By understanding the economic forces behind capitalism, it is possible to

overturn them through struggle and replace them with economic laws that put

people’s needs before profits and eliminate the source of economic

crises.

Articles copyright 1995-2012 Workers World.

Verbatim copying and distribution of this entire article is permitted in any medium without royalty provided this notice is preserved.

Workers World, 55 W. 17 St., NY, NY 10011

Email:

[email protected]

Subscribe

[email protected]

Support independent news

DONATE