Emergency jobs program needed

By

Fred Goldstein

Published Jan 25, 2009 9:56 PM

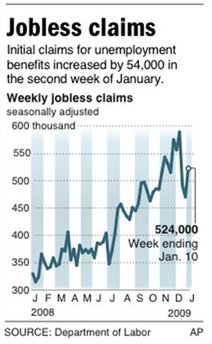

The record wave of layoffs that seemed to peak in December is continuing into

2009.

At the same time, hundreds of billions of dollars in aid are flowing from

Washington to the banks and corporations, not to the unemployed. Reviving

corporate profits has taken precedence over providing desperately needed jobs

or calling for an immediate end to foreclosures and evictions.

Circuit City announced it is laying off 34,000 workers by the end of

March—the largest mass firing since the current crisis began. This

second-largest electronic retailer in the U.S. is closing 557 stores.

Just in the first two weeks of this year a series of other layoffs has been

announced.

Motorola, which laid off 3,000 workers last October, has announced another

4,000 jobs will be cut. Hertz announced 4,000 jobs will go worldwide.

ConocoPhillips will lay off 1,350, Pfizer 2,400, WellPoint 1,500, Saks 1,000

and Neiman Marcus 375. Advanced Micro Devices (AMD), Blue Cross/Blue Shield and

other large companies are also scheduled to announce new rounds of layoffs.

These are only the most publicized firings.

The official unemployment rate, which was 7.2 percent at the end of 2008, is

expected to shoot up rapidly in the coming months as the bosses continue the

onslaught without mercy.

However, there is a less publicized but also official figure called

“total” unemployment—and it has reached 13.4 percent. The

first thing to remember about this figure is that it amounts to 20 million

workers. It includes people who couldn’t get anything but part-time work

when they need to work full time, plus the millions who have stopped looking

altogether, termed “discouraged” workers.

At the present rate, millions more will lose their jobs in the coming months.

Last year 2.6 million lost their jobs—a huge number but still deceptively

low when trying to project what will happen this year because, of the 2.6

million, 2 million lost their jobs just in the last four months of 2008.

There is no question that an emergency jobs program, which would involve the

immediate direct hiring of millions of workers at living wages, with benefits,

and a freeze on layoffs, is urgently needed to stave off the growing crisis of

the working class and the oppressed people.

However, instead of reaching out directly to assist the workers who are

suffering from the capitalist crisis, Washington and Wall Street are reaching

out to bolster the capitalist system and aid the capitalists who caused the

crisis in the first place.

Why ‘stimulus’ can’t work

Wall Street told the incoming Obama administration to get hold of the $350

billion fund Congress passed to bail out the banks and use it to clean up their

bad loans. In addition, the Democrats have submitted an $825 billion

“stimulus” package.

There are many progressive features to the package, such as increases in Pell

grants, reduction of payroll taxes for workers, rural assistance, additional

food stamp aid and unemployment insurance. But these features, including the

declared goal of creating 3 million jobs in the next two years, are utterly

inadequate to meet the massive crisis that is unfolding at a rapid rate.

The package calls for $550 billion in direct spending over two years. Some 90

percent of this spending will go through private capitalists. The bill sets up

contract procedures and deadlines that range from one year to more than two

years for fulfillment. It has no mandatory hiring or wage requirements, save a

nebulous “prevailing wage” stipulation. There is no requirement to

stabilize employment by requiring that workers be retained for any period of

time, nor any funds to provide such stability.

The 20 million workers already considered unemployed or underemployed—and

this December figure is sure to rise in the new year—will have to wait

for the stimulus package to go into effect. When it does, they will then have

to compete for an estimated 1.5 million jobs to be created this year while the

government bureaucracies at the local, state and federal levels negotiate

contracts with competing capitalist interests and their lobbyists seeking to

get a piece of the pie.

None of these bosses has the goal of providing good jobs at living wages with

benefits. To them, the goal is to revive and maximize profits.

The entire process is corrupt, agonizingly slow, and totally uncertain as far

as the workers are concerned. Furthermore, whatever hiring these bosses do

could be cancelled out within a year or less by the drying up of funds or

shrinking of the market.

The working class and the communities have no other recourse but to begin

organizing on a mass basis to demand jobs now—at living wages.

Need for a direct jobs program

Millions are already unemployed. Millions more face layoffs unless an

immediate, direct jobs program is put in place. It can be done. During the

Great Depression of the 1930s, government jobs were put in place within two

weeks after job programs were set up.

It won’t happen automatically. “Jobs or income” must become a

mass demand, backed up by mobilizations, jobs marches and organizing the

unemployed, in unity with the employed, who also need the security of jobs or

income.

Regarding the bank bailout fund, $20 billion in cash and $100 billion in

government-absorbed losses have been promised to Bank of America, which had

already received $25 billion earlier. Citicorp is expected to announce $10

billion in new losses, which the government will absorb. Citigroup has already

received $45 billion in bailout money and the government has given it a

guaranteed backup of $300 billion to cover problematic loans.

The $350 billion bailout doesn’t include these huge new backup

commitments. Its goal is to make the banks solvent by dealing with hundreds of

billions—the investment bank Goldman Sachs says it’s more like $1

trillion—of remaining bad loans.

The fact is that these bad loans on the books of the banks are for the most

part a mirror image of the suffering of the masses. Why are the loans of

Citicorp, Bank of America and other banks going bad? Because of credit card

defaults, auto loan defaults, student loan defaults, mortgage loan defaults and

every other kind of unpayable debt. As people lose their jobs, have their wages

and salaries cut, lose their health care, etc., they sink deeper and deeper

into debt.

The bankers and the rich investors behind them are losing paper wealth, but

their “balance sheet” problems arise from the direct material

suffering of the masses. The working class and the middle class are unable to

pay their bills, are losing their homes, their cars, their electricity and gas,

their health coverage and every other means of survival.

Banks don’t lend when markets are glutted

The handout to the banks is being justified as an attempt to get them to start

lending to companies and consumers, which will then get the economy rolling

again. But this is a complete fiction. The problem of lending arises not from

arbitrary stubbornness by the bankers. It arises from the lack of opportunity

of the banks and the corporations to make profit once a crisis of capitalist

overproduction hits, with its rising inventories and falling sales leading to

falling production. After all, the bankers are in business to make profit.

The term “overproduction” has nothing to do with whether people

need goods. It is when more commodities have been produced than can be

marketed—i.e., sold at a profit.

The crude facts of capitalist overproduction are obvious. The U.S. auto

industry has gone from producing 16 million cars annually to 13.2 million last

year, and is expected to drop to 12 million or less this year. Steel

production, which is a barometer of the economy, dropped from 2 million tons in

November to 1 million tons in December. In recent decades, hundreds of

thousands of steel workers were laid off as the industry consolidated and

shrunk itself. Now, overproduction has hit again. It is estimated that 20,000

steel workers will be laid off in the coming period.

The overproduction of housing and the consequent crisis in the construction

industry and all its ancillary industries is getting worse with each

foreclosure.

Giant technology companies like Motorola, Nortel, AMD and Intel are suffering

losses due to overproduction and hence executing layoffs. Under those

conditions, the banks see no profit in lending, no matter how much money the

government hands them.

In fact, they are using their bailout money not for lending but to strengthen

themselves financially. According to a New York Times survey of two dozen

banks, “The overwhelming majority saw the bailout program as a

no-strings-attached windfall that could be used to pay down debt, acquire other

businesses or invest for the future.”

At a recent conference at the Palm Beach Ritz-Carlton, “Bankers mingled

with investment analysts at an ocean-front luxury hotel, where the agenda

featured evening cocktails by the pool and a golf outing at a nearby country

club.” They were there to discuss the bailout funds. Referring to the

government’s Troubled Asset Relief Program, conference organizer John C.

Hope III, chairperson of the Whitney National Bank of New Orleans, said,

“We see TARP as an insurance policy.” Hope figures that, “No

matter how bad it gets, we’re going to be one of the remaining

banks.” (New York Times, Jan. 18)

So much for lending, job creation and recovery.

The “crisis” of the bankers and bosses is calmly discussed at

luxury watering holes, while the workers are suffering the greatest attack in

three generations.

The only way to get a real working-class recovery program is to organize to

shake up the entire capitalist system until the bosses are forced to provide

jobs and/or a livable income.

Goldstein is author of the recently published book, “Low-Wage

Capitalism: Colossus with Feet of Clay,” which can be ordered through

www.lowwagecapitalism.com.

Articles copyright 1995-2012 Workers World.

Verbatim copying and distribution of this entire article is permitted in any medium without royalty provided this notice is preserved.

Workers World, 55 W. 17 St., NY, NY 10011

Email:

[email protected]

Subscribe

[email protected]

Support independent news

DONATE